A mismatch in funding ‘resilient adaptation’ strategies could result in a “huge opportunity” for investors, according to Dr Nicola Ranger at the Environmental Change Institute (ECI).

In an article published in Environmental-Finance.com, an online news and analysis service (paywall), Dr Ranger discusses how adaptation and mitigation will become increasingly important for policymakers and management teams alike.

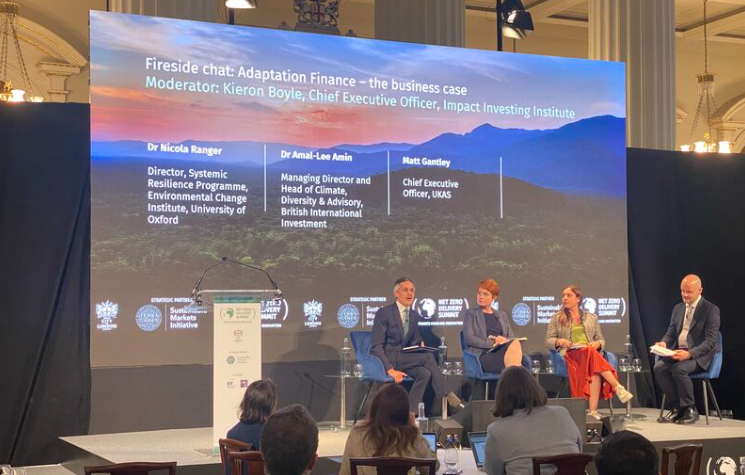

The article follows her recent appearance as a speaker at the City of London Net Zero Delivery Summit. Dr Ranger, Director of the Resilient Planet Finance Lab at the ECI, was on the panel of a talk entitled: Adaptation finance – the business case, alongside Dr Amal-Lee Amin, Managing Director and Head of Climate, Diversity & Advisory, British International Investment and Matt Gantley, CEO, United Kingdom Accreditation Service. The moderator was Kieron Boyle, CEO, Impact Investing Institute.

The talk’s focus:

The effects of climate change are set, even if we meet our carbon mitigation goals tomorrow. Climate impacts such as floods, heat waves and food insecurity will continue and this will affect our homes, how and where we work as well as the public infrastructure we currently enjoy. As such, investment in adaptation and resilience is vital.

To prepare for these changes, substantial capital, and importantly private capital, will need to play a significant role. This fireside chat will explore the opportunities for private capital to support adaptation, considering questions such as: is adaptation and resilience investment a risk mitigation strategy or are there opportunities that could be leveraged if we invest in adaptation now? Where are there examples of the private sector already successfully investing in adaptation projects, and what can we learn from these?

Speaking at the Summit Dr Ranger said a funding gap is emerging as not enough finance is being allocated to adaptation strategies. She said:

Of all the green bonds issued, approximately 16% are going into adaptation. Whereas only 3% of sustainability-linked bonds are looking at adaptation – which is a huge difference between issuance and the volume of companies looking at it.

There’s a huge opportunity for these markets over time. Every business will need to think about how it is adapting to the climate – considering how it is taking opportunities from the changing climate and how it can support a resilient future, and the opportunities in that. That means this is an enormous opportunity.

Every government, every city and every business are going to have to invest in a resilient transition at the same time as a net-zero transition.”

She added that she would like to see negotiations putting adaptation transition “equal in focus” to the net-zero transition at COP29 in Azerbaijan later this year.

I’d like to see clarification on what are a key set of targets and metrics coming out of the COP29 negotiations. We worked with the UNEP FI to look at what existing standards and to what extent they are already looking at adaptation. We found around 300 different adaptation targets and metrics that already exist within standards bodies – the ISSB and GRI, for example – as well as 35 adaptation taxonomies.

We’re not short of metrics, but we’re in fact short of good examples of how to use those in practice and boiling them down to where they’re used in specific decisions.”

Watch the Summit on demand.